An entity should maintain Sales Journal in the prescribed format by generally accepted accounting principles for an accounting of credit sale transactions so that Debtors’ records and credit sales records can be managed. If you have accounting software or a bookkeeper, you may not be making these entries yourself. But knowing how entries for sales transactions work helps you make sense of your general journal and understand how cash flows in and out https://x.com/bookstimeinc of your business. You can see how these journal entries (using the perpetual inventory method) would be recorded in the general ledger as by clicking fooz ball town to save space.

- At the end of the month, the total of $2,775 would be posted to the Accounts Receivable control account in the general ledger.

- If the payment is made in cash, the column becomes the sales column, but when it is paid on credit, the column becomes account receivables.

- It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately recorded or not.

- The identification number mentioned in the invoice allows for helping track down that particular sale.

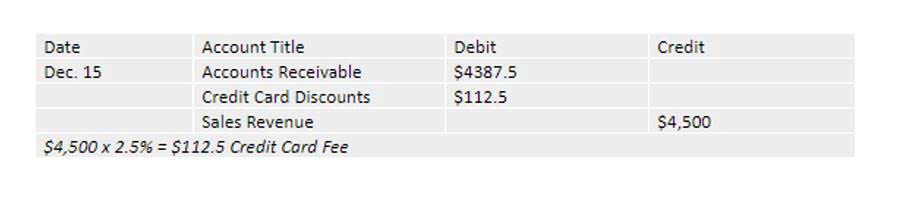

- In the next section, we’ll talk more about what each debit and credit means for the sale entry.

Get in Touch With a Financial Advisor

A notation would be made in the reference column to indicate the payment had been posted to Baker Co.’s accounts receivable subsidiary ledger. After Baker Co.’s payment, the cash receipts journal would appear as in Figure 7.21. The use of a reference code in any of the special journals is very important. Remember, after a sale is recorded in the sales journal, it is posted to the accounts receivable subsidiary ledger, and the use of a reference code helps link the transactions between the journals and ledgers.

- This means that when you debit the sales returns and allowances account, that amount gets subtracted from your gross revenue.

- Accounting information systems were paper based until the introduction of the computer, so special journals were widely used.

- The total of all of the cash disbursements for the month would be recorded in the general ledger Cash account (Figure 7.27) as follows.

- You also have to make a record of your inventory moving and the sales tax.

- Some businesses keep a different purchase and sale journal, while some journals keep the record of purchases and sales in the same journal.

- The information in the sales journal was taken from a copy of the sales invoice, which is the source document representing the sale.

What is the approximate value of your cash savings and other investments?

This software also allows the inventory to be automatically updated when a specific good is running low on inventory, by automatically ordering that particular good from the supplier. There are two sides to every accounting book; it is the same for a sales journal. The sale of the LED light would bring 100 Dollars to the company.

Related AccountingTools Courses

In the next section, we’ll talk more about what each debit and credit means for the sale entry. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Each line represents the information from a sales invoice. This is done to unearned revenue avoid the chances of fraud to avoid any unnecessary losses.

Many businesses estimate tax liability and make payments throughout the year (often quarterly). When a company overestimates its tax liability, this results in the business paying a prepaid tax. Prepaid taxes will be reversed within one year but can result in prepaid assets and liabilities.

Many companies enter only purchases of inventory on account in the purchases journal. Some companies also use it to record sales journal purchases of other supplies on account. However, in this chapter we use the purchases journal for purchases of inventory on account, only.

Cash Receipts Journal

- You use accounting entries to show that your customer paid you money and your revenue increased.

- Since the purchases journal is only for purchases of inventory on account, it means the company owes money.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- A sale made in cash would instead be recorded in the cash receipts journal.

- Recall that the accounts receivable subsidiary ledger is a record of each customer’s account.

To create a journal entry in your general ledger or for a sale, take the following steps. Account receivables are mentioned when the client purchases a product or service on credit, and sales are mentioned when the client purchases a product or service and pays for it through cash. Using the reference information, if anyone had a question about this entry, he or she would go to the sales journal, page 26, transactions #45321 and #45324. This helps to create an audit trail, or a way to go back and find the original documents supporting a transaction.